Digital, AI-optimized & efficient.

How banks improve their receivables management: faster payments, lower costs and more satisfied customers

Overdue receivables are critical for banks' liquidity and balance sheets. However, receivables management is time consuming and ties up staff. Thanks to AI and automation, our solution brings significantly more efficiency to processes and improves the payment ratio.

Challenges for banks: receivables management

Risks from overdue receivables, limited resources and inefficient processes

Open and overdue receivables are naturally very important for banks' balance sheets. This is all the more true in an environment of stricter accounting rules and higher interest rates. Items such as missed loan installments are a burden on liquidity and entail additional risks due to the potential loss of receivables. In the case of credit cards, it is also important to weigh up the factors of interest income, reminder fees and bad debt losses. Our AI-based, customer centric solution for receivables management can help here by reducing days sales outstanding (DSO). Data driven approaches and customer friendly options, e.g. for payment options, increase the willingness to pay. The result is demonstrably higher payment rates.

Receivables management at banks still involves a high degree of manual work steps. On top of this, these have to be carried out by a notoriously limited workforce. Modern solutions help financial institutions to greatly reduce the necessary effort through automation and lower the workload on staff. Digital workflows for different customer journeys ensure efficient, seamless processes, precisely tailored to the end customer. This also improves the customer experience.

More efficient receivables management with the collect.AI platform

Optimizing results in receivables management through AI-supported decisions

Flexible digital processes

Our Workflow Builder supports you in mapping your existing processes in a fully digitalized way. Use the intuitive flexibility of a drag & drop user interface to digitally display existing processes and optimize them with the help of our AI Smart Assistants.

Automation through smart assistants

Smart Assistants are AI modules that help you to automate and optimize processes. Our "Smart Intent Recognition" assistant, for example, analyses the written responses of your end customers and recognizes and classifies customer feedback.

Automation through smart assistants

Smart Assistants are AI modules that help you to automate and optimize processes. Our "Smart Intent Recognition" assistant, for example, analyses the written responses of your end customers and recognizes and classifies customer feedback.

All key figures at a glance at all times

With the help of our dashboard, you are always up to date. The analyses of our Workflow Insights help you to optimize processes, identify weak points and unleash potential through intelligent measures.

Core competencies in receivables management

All relevant features combined on our platform

Payment methods

Our platform offers the option of selecting a variety of payment methods for you, giving your end customers the opportunity to use their preferred payment method. Whether traditional methods such as SEPA direct debits and credit cards or modern options such as PayPal or instant bank transfer - we support a wide range to make the payment process as convenient and simple as possible. The flexible control of payment options allows you to dynamically adjust them depending on the progress of the process in order to optimize payment rates and actively manage your costs. This increases your customers' willingness to pay and improves your company's cash flow.

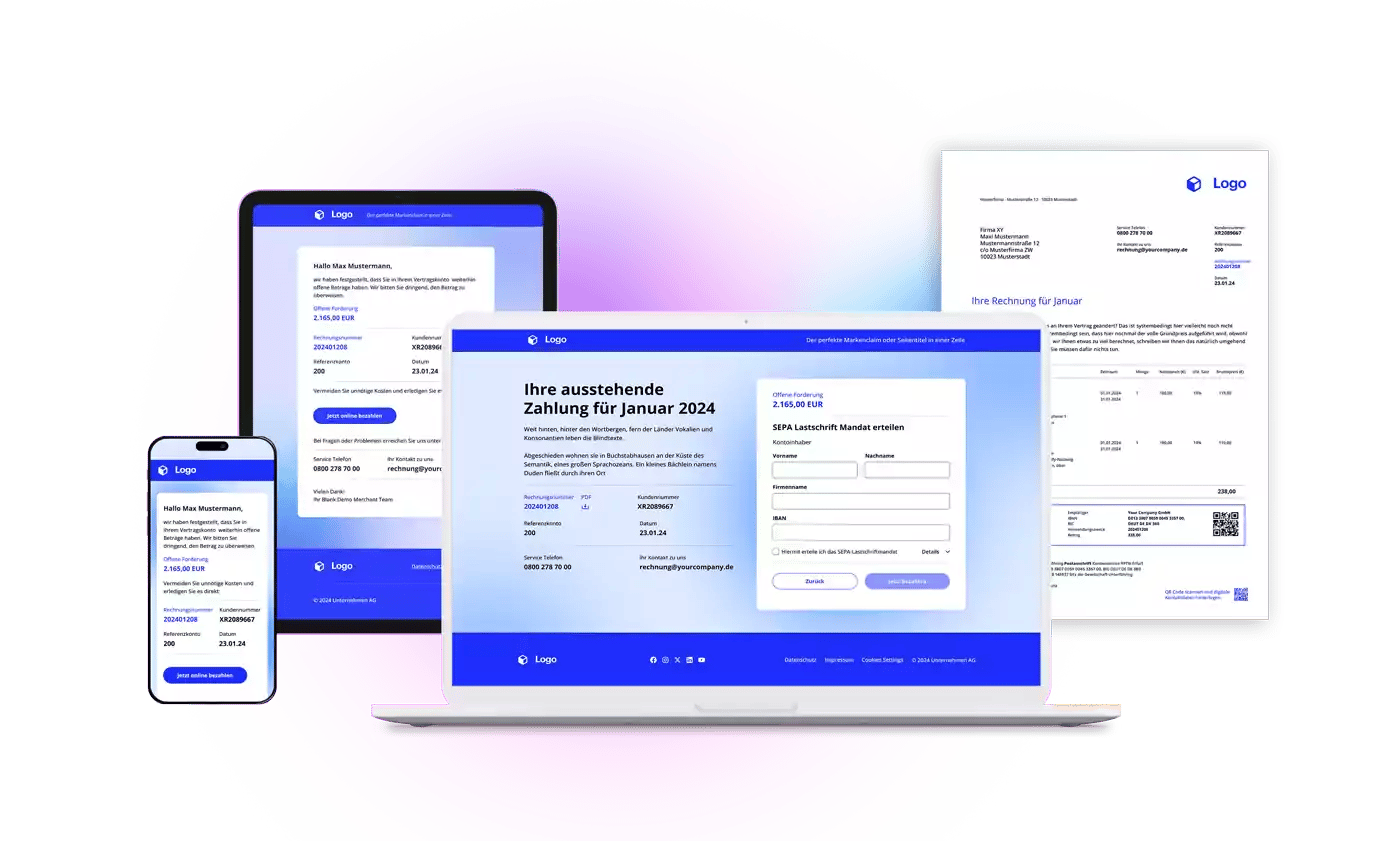

Whitelabel solution

With our white label solutions, companies can fully maintain their brand identity in customer communication. By adapting the communication design to your corporate identity, a consistent brand experience is guaranteed for your end customers. Our platform allows you to edit and centrally manage texts and designs without any programming knowledge. In addition, white label landing pages can be configured, offering a variety of payment methods and personalized options. This solution offers maximum flexibility and strengthens customer loyalty through a uniform and professional appearance.

Whitelabel solution

With our white label solutions, companies can fully maintain their brand identity in customer communication. By adapting the communication design to your corporate identity, a consistent brand experience is guaranteed for your end customers. Our platform allows you to edit and centrally manage texts and designs without any programming knowledge. In addition, white label landing pages can be configured, offering a variety of payment methods and personalized options. This solution offers maximum flexibility and strengthens customer loyalty through a uniform and professional appearance.

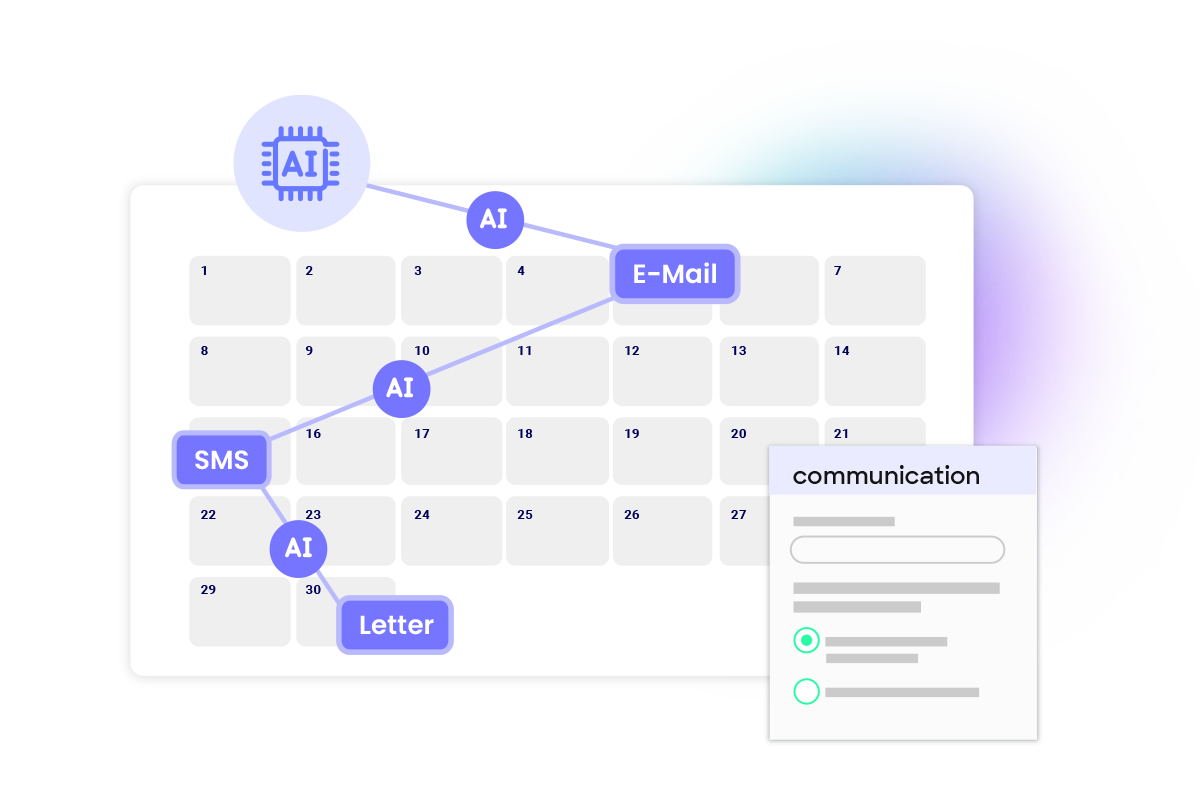

Communication channels

The communication channels offer you the flexibility and efficiency you need to reach your customers in the best possible way. Our platform supports a variety of communication options such as email, SMS, WhatsApp and letter with QR code to ensure your messages always reach the right recipient. With the Workflow Builder, you can flexibly design and customize the entire communication route. This intuitive drag & drop editor allows you to create and centrally organize complex dunning processes without any programming knowledge.

Challenges for banks: AI

Backlog demand for AI technology

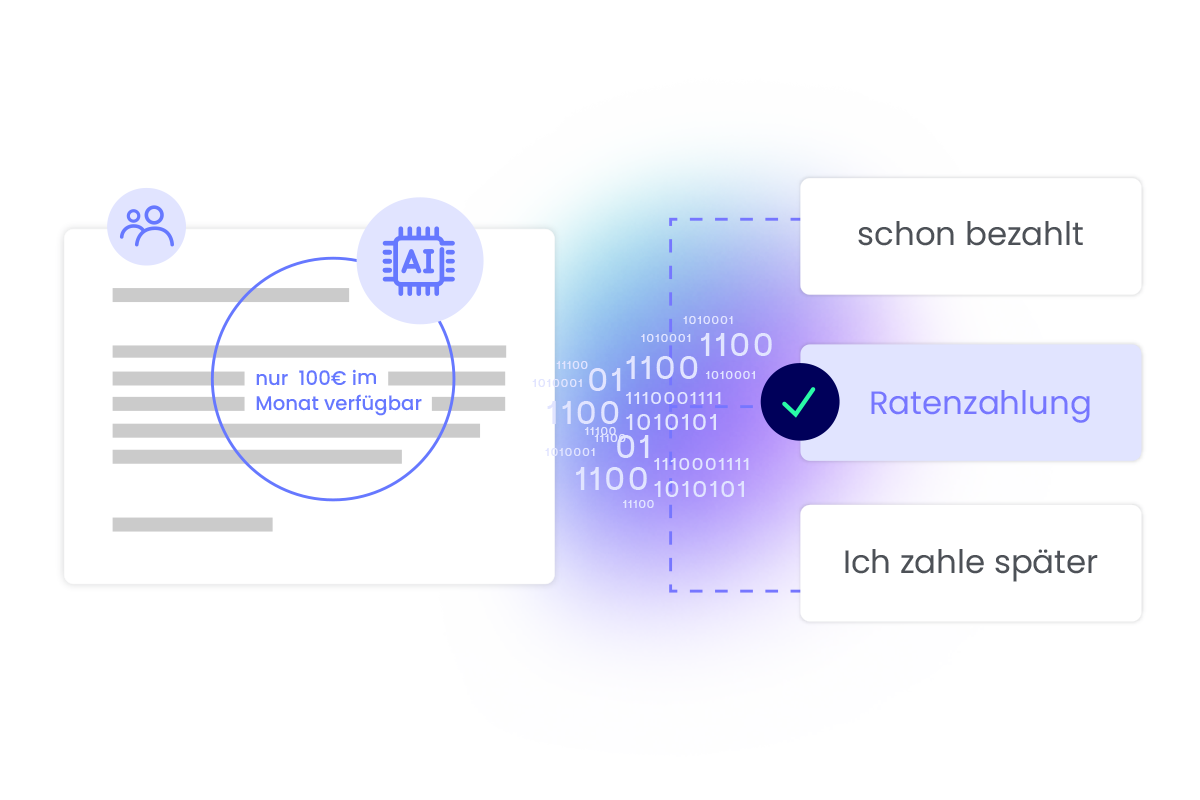

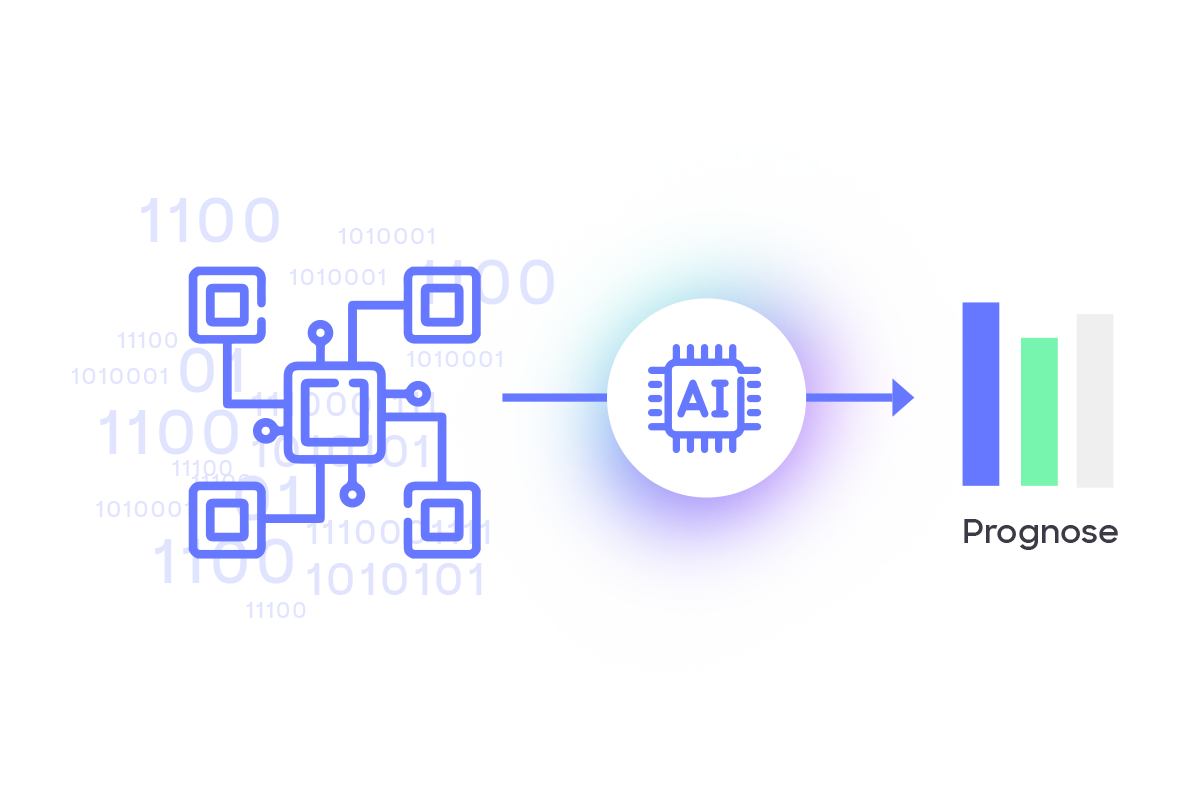

Artificial intelligence (AI) has been on everyone's lips since the publication of ChatGPT at the latest but is still only rarely used by banks. Yet there are excellent use cases in receivables management in particular. Our AI assistants support processing at several critical points in the receivables process. The "Smart Communication" assistant improves customer communication by automatically selecting the best time and channel for messages. The "Smart Intent Recognition" assistant identifies the intent of customer letters by word choice and tone of voice in order to then assign them to the right team. The "Payment Probability" assistant uses historical and current data to determine the payment probability of customers and the expected time frame. These three applications show that AI brings tangible benefits to receivables management in terms of efficiency, employees and results.

Smart Intent Recognition

Reduce operational costs & optimize customer experience

Payment Probability

Make forecasts & improve liquidity planning

Smart Communication

Optimal times & intelligent channel selection

Pioneering work in the field of receivables management

Superior AI solutions for your receivables management

8 years

of AI learnings. During this time, it has specialized in optimizing receivables management processes through the use of smart assistants.

20 billion

euros in receivables have since been processed with over 50 customers from many different sectors.

260 million

processes were analyzed by our AI systems in compliance with the GDPR. Even without data pooling, we achieve highly precise AI models that serve as the basis for smart applications that offer real added value.

The future of order-to-cash management with AI-powered smart assistants

Our innovative Smart Assistants use advanced AI technology to optimize order-to-cash management, reduce costs and improve your customers' payment behavior. The data based solutions access a variety of data sources, analyse them using state-of-the-art algorithms and provide valuable insights for process optimization.

They integrate seamlessly into the order-to-cash platform and collect data from transactions, master data and customer feedback. This raw data is analyzed by AI algorithms to automate and optimize processes. Automated processing of repetitive tasks reduces manual effort and enables cost reductions through detailed insights into process flows.

An intuitive dashboard provides in-depth insights into the results of the processes optimized by the platform and supports strategic decisions. Our solutions are scalable and adapt to individual needs and company sizes.

In contrast to conventional, static dunning processes, our Smart Assistants enable dynamic and data oriented process optimization. This allows you to make your receivables management processes more efficient, reduce costs and improve your customers' payment rates.

Challenges for banks: Integration & Regulation

Legacy ERP systems slow down innovation

A sore point for many banks is the use of outdated legacy systems, especially in the area of enterprise resource planning (ERP). Some of the software has been in use for decades. However, such legacy systems do not meet modern requirements in terms of data availability, interoperability and the use of innovative capabilities such as AI or the cloud. They are therefore hindering the transition to the data-driven banking of the future. This is why some banks are currently starting to switch to cloud ERP systems. As a complete replacement is associated with high costs and risks, banks often opt for an incremental modernization strategy. Modules with new capabilities are introduced step by step and connected via middleware or API in order to open up the potential of data-driven banking - for example with our AI-based solutions for receivables management.

REST-API integration

Advantages

-

Simple linking

Applications are connected quickly and easily via their REST APIs. This can be done internally or via third-party solutions. -

Real-time data exchange

Enables immediate and continuous data transfer between different systems. -

DIY integration

Customers can use their IT and business resources to design and implement the integration themselves. This provides maximum control and customization.

Ideal for

-

Companies with sufficient IT resources and capacities.

-

Companies with a middleware or hybrid integration platform.

-

Companies that prefer to integrate third-party apps via APIs.

-

Companies with their own Solution Integrator

Enterprise connectors

Advantages

-

Standardized connectors

Available for leading enterprise systems such as Powercloud, SAP, Salesforce and more, and can be used in various client setups with no or minimal customization. -

Managed components

collect.AI takes care of the implementation, customization and maintenance of the connectors so that you can concentrate on your core business. -

Efficient integration

Thanks to the Integration Hub, all components are managed centrally, which simplifies implementation and maintenance.

Ideal for

-

Companies that use common IT systems for which collect.AI offers enterprise connectors.

-

Companies that do not have sufficient IT resources or middleware/hybrid integration platforms.

Custom build integrations

Advantages

-

Customized connectors

Ideal if the standard solutions are not sufficient or if there are technical/organizational restrictions. These connectors can be fully customized to your specific requirements. -

Alternative solutions

In addition to user-defined connectors, we also offer solutions such as file exchange with user-defined ETL processes to ensure maximum flexibility. -

Dedicated project team

An experienced team defines the business and technical requirements and ensures smooth implementation. -

Managed components

collect.AI takes care of implementation, customization and maintenance so that you can concentrate on your core tasks.

Ideal for

-

Companies whose IT systems do not support ready-made or company-specific connectors from collect.AI.

-

Companies that use older IT systems.

-

Companies with very specific use cases.

-

Companies without sufficient IT resources or middleware/hybrid integration platforms.

Data protection, regulation, compliance

Banks operate in a highly regulated industry environment. Requirements such as the Banking Authority IT Requirements (BAIT), the Digital Operational Resilience Act (DORA) and data protection legislation (GDPR) must be met. For innovative data-driven capabilities based on AI, the EU AI Act, which has been in force since 01.08.2024, must also be observed. Our solutions meet all applicable requirements through anonymization of personal data, high security and GDPR standards and comprehensive compliance.